Two of the most commonly used technical indicators of momentum in trading are the moving average convergence divergence, or MACD, and the Relative Strength Index (RSI). Today Jeffrey Kennedy is going to be looking at RSI. It was developed by legendary trader J. Welles Wilder. It is a “momentum oscillator”. As the price of a security rises, price momentum increases. The faster the security rises (the greater the period-over-period price change), the larger the increase in momentum. Once this rise begins to slow, momentum will also slow. Our NYSE ROC chart is a type of Momentum chart.

Top 3 Technical Tools Part 1: Japanese Candlesticks

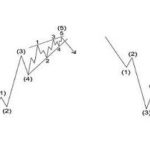

Jeffrey Kennedy to name 3 of his favorite technical tools (besides the Wave Principle). He told me that Japanese candlesticks, RSI, and MACD Indicators are great methods to support Elliott wave trade setups.

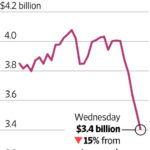

When Prices Are Falling, TWO Numbers Matter Most

On June 29, the Apple iPhone turned 10 years old. But, for many, the mood surrounding the milestone was less than celebratory. Reason being, in June alone, Apple Inc. (AAPL) plunged 6% to two-month lows amidst a broad-scale bruising of the global tech sector.

Crude Oil Sinks 20% Despite OPEC Production Cuts

On January 1, the long-awaited agreement between OPEC and its major exporting partners like Russia to curtail production by 1.8 million barrels a day went into effect. And, according to the mainstream experts, the massive effort to cut the oil glut would also light the fire beneath oil prices. But that’s not what happened…

Robert Prechter Talks About Elliott Waves and His New Book

It’s been a long time since we’ve offered you an article featuring Robert Prechter directly. We’re especially excited to offer you this thoughtful interview Avi Gilburt conducted with Bob.

Trump Bump Slaughters Market Bears

Much of the post-US election rally in the stock market has been attributed to President Donald Trump’s promises for tax cuts and deregulation. But long before the election, Elliott wave price patterns already told our subscribers to prepare for a market rally.

Elliott Wave Analysis: Where the RUBBER Meets the Road

There are nearly 50 commodity markets traded all over the world at any given time. That’s one for every state in the United States. So, how is an investor or trader supposed to know which of these markets to follow and which ones to dismiss?

Learning to Recognize Trade Setups with “MACD”

According to Investopedia – the Moving Average Convergence Divergence (aka. MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA.

Active vs Passive Investing: And the Winner Is …

Total index investing today exceeds 4 Trillion dollars.Why has the share of index fund investing gone from basically zero in 1985, to more than 35% in 2016?