The Personality of Stock Market Waves Each Elliott wave has its own “personality.” In this video Wayne Gorman shows the psychology behind the waves and how it affects your investment decisions. See how the market swings from extreme pessimism through a sense that we are going to survive resulting in cautious optimism but then pessimism returns […]

What Does a Fractal Look Like?

And What Does It Have to Do with the Stock Market? Fractals are common in nature but you don’t expect them in the stock market. But as you’ll see in this article fractals are found almost everywhere and by understanding them you can better predict the future direction of the stock market. May 26, […]

Elliottwave For- Where Technical Studies Fall Short

5 Ways the Wave Principle Can Improve Your Trading May 12, 2011 By Elliott Wave International Every trader, every analyst and every technician has favorite techniques to use when trading. But where traditional technical studies fall short, the Wave Principle kicks in to show high-probability price targets. Just as important, it can distinguish high-probability trade […]

Gold Elliott Wave- How Long and How High?

In today’s editorial, David Banister takes a look at Gold and where it could be going. He provides an excellent possible scenario that matches with my views and experience exactly. He is projecting a rally to the $1500 range with a pull back from there and a major take-off for the final wave to the […]

Slicing the Neckline: A Classic Technical Pattern Agrees with the Elliott Wave Count

In the August issue of his Elliott Wave Theorist, market forecaster Robert Prechter alerted readers that the U.S. stock market was slicing the neckline of a classic head-and-shoulders pattern in technical analysis, and that this may send the market into critical condition. Prechter said that when the Elliott wave count and a head-and-shoulders pattern are […]

Applying Elliott Wave Theory to Recent Trades

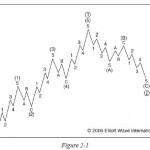

Ralph Elliott, an American market analyst, discovered the basic principles in the 1930s studying the Dow Jones Index

Video: The Real-Time Power of Elliott Wave Analysis

Mainstream financial analysts always look for ways to explain market action through news stories and events. Conventional wisdom states that news and inter-market correlations cause market booms and busts, but such explanations rely on selective presentation of the data. In this video, Elliott Wave International’s Asian-Pacific Financial Forecast Editor Mark Galasiewski shows you how Elliott […]

What Becomes of a Broken Stock Market?

You know what a mystery the Dow’s 1,000-point drop on May 6 has been. Wall Street is looking for a smoking gun — a trader’s mistake, a computer glitch — but nothing definite has been found yet. If you’re familiar with Elliott wave analysis, last week’s shocking decline gets less mysterious.