The following article was written by Gary Tanashian editor of Notes From The Rabbit Hole (NFTRH) and originally appeared here. In it Gary looks at the current “Dysfunctional Market” the FED manipulation called “Operation Twist” that caused it along with Gold, Silver, plus inflation and deflation. I like his quote about the effects of inflation, “Funny money on the run… is not discriminating money. It seeks assets… period.” and he holds that that is the primary reason why the stock market has risen since 2011.

Stocks And Bonds- Testing Key Areas

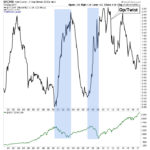

While the S&P 500 (SPY) was able to push to a new high during Monday’s trading session, the broad NYSE Composite Stock Index (VTI) was still looking for a close above an area that acted as resistance in the past.

Bonds Continue To Flash Warning Signs For Stocks

When investors are fearful, common sense tells us demand picks up for more conservative assets, which is exactly what happened early Monday morning. When investors are very pessimistic and fearful, return of principal becomes highly important. Therefore, when fear increases we would expect to see defensive bonds outperform growth-oriented stocks.

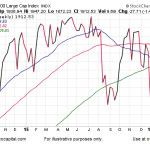

How Is The Bullish 1994 Stock Analogy Holding Up?

In today’s post Chris Ciovacco of Ciovacco Capital gives us some interesting insight into the current market situation and answers the question:

Is the Market Rallying or is it just a “counter-trend” rally?

He also discusses the three Market myths

And he has a great instructional video at the end.

Global Stocks Slide

“When the alarm goes off and the dreamers awake, it will be pandemonium in the stock market.” — Bob Prechter

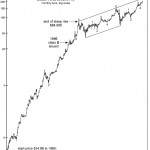

Economic Cycles of Energy and Technology

Everything moves in cycles whether it is the price of a barrel of oil, the overall stock market, real estate or technology. So where is it heading from here? Are we in for a boom or a bust? That is always the key question. Is it time to be skeptical of the markets, bullish on gold, or does the stock market hold the key? In today’s article Jared Dillan editor of Bull’s Eye Investor, takes a look at where we’ve been and where we are going.

Is This Lagging Sector Ready To Lead?

Investing is about probabilities. The improving fundamental and technicals in the housing sector tell us the odds of success in that sector are also improving. It should be noted that even if the weekly trends continue and homebuilders lead, that does not remove normal retracements and pullbacks from the equation. The odds of good things happening in homebuilders are better today than they were in early October.

Top Approaching in Berkshire Hathaway?

By Elliott Wave International Editor’s note: The following article originally appeared in a special September-October double issue of Robert Prechter’s Elliott Wave Theorist, one of the longest-running financial letters in the business. It piques our interest when a person or company makes the front page of a magazine or newspaper. On August 15, USA Today […]

Scared of Stocks? There Are Ways To Monitor Risk

‘Great Rotation’ Includes Safe Money Markets The equity side of Wall Street coined the term great rotation to describe what they hoped would be a mass migration by investors from bonds to stocks. Many investors have not forgotten when the S&P 500 plunged 50%-plus (2007-2009). From the Wall Street Journal: Investors are cashing out of […]

Bulls are Still in Control- Yellow Flags Raised

As of the close Tuesday, the bulls remained in control, but there are reasons to pay attention this week with an open mind: Bond yields are falling, which leans risk-off. The ratio of stocks vs. the VIX is facing overhead resistance. The ratio of stocks vs. bonds has stalled. The European economy remains vulnerable. Bond […]