As you probably know, Hurricane Ida hit Louisiana on August 29, the exact date that Hurricane Katrina made a Louisiana landfall sixteen years earlier.

On August 30, the Wall Street Journal said:

Oil Industry Surveys Damage After Hurricane Ida Slams Louisiana

The storm disrupted fuel supplies, and the speed of the recovery will depend on how long it takes for refineries to come online amid flooding and power outages.

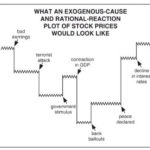

Did oil prices skyrocket due to the disruption in oil production? Well, Bloomberg reported (August 30) that prices initially fell 1.6% [as Ida made landfall] before they “edged” higher.