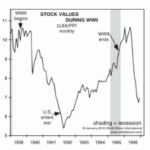

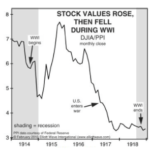

Many people believe that “War is good for Stocks” because the government pumps billions into the economy thus creating jobs and those new employees spend money having a multiplying effect on the economy. And when the economy booms the stock market booms right? In the following chart we can see that shortly after the U.S. entered WWII that the stock market began rising and it continued to rise throughout the remainder of the war. This is possibly why U.S. investors have come to believe that “War is Good for the Market”. But…

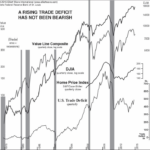

Is the Falling Trade Deficit Good for Stocks?

If the Balance of Trade is Negative i.e. Imports are greater than Exports a country will have a net outflow of currency and theoretically it will go broke. However, over the years the U.S. has been able to maintain a negative balance of trade by borrowing money from other countries i.e. selling them Treasury Bills, Bonds and Notes. So they give us money to buy stuff from them. On March 27, CNBC said that “the U.S. trade deficit fell much more expected in January to $51.15 billion, from a forecast $57 billion. The decline of 14.6 percent represented the sharpest drop since March 2018…” You would think this would be good for our economy as we are producing more and borrowing less. But it could also mean that we are buying less because our buyers have less money to spend. Conventional wisdom says that a falling trade deficit is good for stocks.There are many widely held beliefs about the stock market that are unverified, questionable or simply untrue. Even professional market observers often neglect to investigate these widely held beliefs for themselves — and their clients. Consider the claim that a falling trade deficit is good for stocks, and vice versa. In this article from Elliott Wave International they look at the relationship between a falling trade deficit and the stock market.

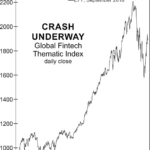

Is Banning “Short-Selling” a Solution?

You may not have thought about it but short selling is a key component of modern efficient markets. Typically when you buy and sell things you buy them first hold them for a certain time (whether it is short or long term) and then sell it, (hopefully for more than you paid for it). But what if you feel the item is currently waaay too expensive? In that case, you can “sell short” in this case you borrow the item from a broker, sell it and when the price goes down buy it and return it to the broker. (Of course you have to pay the broker for any missed dividends and a “fee” for loaning it to you). But if the stock falls enough you can make a nice profit. According to Investopedia, “Short selling strengthens the market by exposing which companies’ stock prices are too high. In their search for overvalued firms, short sellers can discover accounting inconsistencies or other questionable practices before the market at large does.” So in effect, short sellers are registering a “negative vote” saying that they believe this stock is overpriced. But when bull-market hope turns to bear-market fear, short selling is often vilified as the cause of market crashes (rather than the fact that the short sellers were just observant enough to recognize overpriced stocks when they see them). This shift may be underway in Europe now. Whenever new technology enters a market it causes disruptions and eventually the old tech suffers as it is displaced by the new. Right now “FinTech” or Financial Technology is causing disruptions in Europe and as you would expect, the traditional financial services companies don’t like it. But the public becomes enamored with the new tech and drives up the price (often to extremely unreasonable levels). Once “irrational exuberance” takes over and the price of the stocks gets carried away then the short sellers come in with their “the emperor isn’t wearing any clothes” and the price of the new tech crashes until it can build a firm base, show real profits and begin climbing again. ~Tim McMahon, editor.

How to Build Consistent Trading Success

You’ve heard it all before:

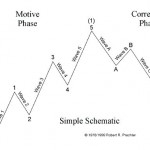

If you want to trade using Elliott wave analysis, to succeed you first need to understand its rules and guidelines.

You need a clearly defined trading strategy (what? when? how? etc.) and the discipline to follow it.

Additionally, your long-term success depends on adequate capitalization, money management skills and emotional self-control.

Do you meet these qualifications, yet still struggle in the markets? If so, you may find some helpful advice in this quick trading lesson from Trader’s Classroom editor, Jeffrey Kennedy:

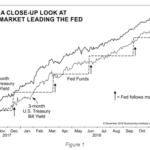

Interest Rates Win Again as Fed Follows Market

Most economists and financial analysts believe that central banks set interest rates. For more than two decades, Elliott Wave International has tracked the relationship between interest rates set by the marketplace and interest rates set by the U.S. Federal Reserve and found that it’s actually the other way around–the market leads, and the Fed follows.

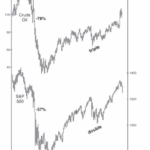

Are Falling Oil Prices Really Good for the Stock Market?

It makes sense that falling oil prices would be good for stocks, after all it should lower company’s cost for energy and therefore increase profitability. However, in October 2018 both Oil prices and Stock prices fell simultaneously. So, “What’s Up with that?” In today’s post the Editors at Elliott Wave International will look at the relationship between Oil and Stocks.

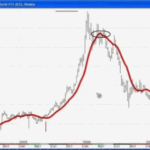

Moving Averages Help You Define Trend – Here’s How

The “moving average” is a technical indicator of market strength which has stood the test of time.

Are Wars Bullish or Bearish for Stocks?

The following article was originally published by Elliott Wave International under the title Is War “Hell” for the stock market? And it looks at the stock market performance during various wars and also during times of peace to see if there is a correlation between the market performance and the existence or absence of war.

Urgent Message: Two Must See NASDAQ Charts

The NASDAQ index was launched in 1971 as the world’s first electronic stock market. With $7 Trillion in market capitalization it has grown to become the second largest market behind the NYSE. The NASDAQ has been in an upward sloping channel since 2011. But now something has happened. See this video for more information.