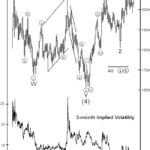

Gold’s three-month implied volatility has declined to its lowest level in over four years. While low volatility is not a short term timing tool, low volatility eventually precedes high volatility. At the same time, total open interest in gold futures has declined to its lowest level since December 2018, as traders are either closing futures contracts or abstaining from opening new ones. The low level of open interest means that investors’ attention is turning away from gold, and the low implied volatility indicates that investors do not expect gold to move much over the course of the next three months. Both are preludes to what we see as a major move forming in gold prices.

Gold: Setting Near-Term Price Targets

Even though the mainstream media was looking to so-called fundamentals — such as the action of the dollar or bond yields — Elliott Wave International focused on the patterns of investor psychology

Gold: See What This Fibonacci Ratio Says About the Trend

Gold has been a star performer in the markets recently with gold making a new all-time high of $2067.15 on August 6th. From there it retreated to $1931 on August 12th before resuming its climb. On August 18th it closed just above $2000 and then retreated to $1927.90 on August 19th . So we have seen quite a bit of volatility this month in gold. It certainly would be nice to know beforehand where it would stop and turn.

Do Facts Support Doom and Gloom or Higher Highs for Stocks and/or Gold?

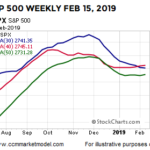

Dating back to 1950, the S&P 500 has only dropped over 40% three times: 1973-74, 2000-02, and 2007-09. In each case after the big drop, something caused investors to change their attitude and behavior related to the attractiveness of common stocks. Major lows are rare and the shifts that occur in the minds of human beings near major lows are rare. History tells us valuable information can be found in rare market events.

Is Gold on the Verge of a Bottom?

From 2017 until now the Gold chart shows another 75% price retracement from recent highs once again. This second 75% retracement could be a massive bottom formation setting up in Gold and could be a huge “wash-out” low price. We believe this unique retracement is indicative of a massive price breakout over the next year or so as the price of gold is forming what Stan Weinstein calls a Stage 1 Accumulation.

Gold: Often, Simple Forecasting Tools Are All You Need

In the following video by Elliott Wave International we will look at the gold price and “Commitment of Traders” In 2017, Gold ‘s rally has stalled three times in April, June and August. With April and June’s price stalling at the same overhead resistance level. Back in August Elliott Wave TV said, When analyzing charts […]

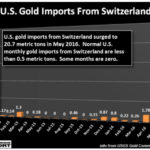

Something Strange in the Gold Market

Gold has a strong negative correlation to other assets. That means that when other markets fall gold can hold steady or even rise. This makes it the ultimate portfolio insurance.

Elliott Wave Projecting Gold Bottom?

By David A Banister We have been writing about the bottoming process of the Gold Bear Cycle (Elliott Wave Theory) since December 4th 2013, and our most recent article on December 26th reiterated that the best time to accumulate the Gold/Silver stocks was in the December and January window. Specifically this is what we wrote: […]

Gold and Silver: A Great Day to be a Bear

Elliott wave analysis is the blade-proof glove with which “to catch a falling knife” By Elliott Wave International In the wee morning hours before dawn on Thursday, June 20, the precious metals’ rooster crowed, “Cock-a-doodle-DOH!” It was the ultimate wake-up call: First, gold prices plummeted 4% then 5% then 6% below $1300 per ounce to […]

Investors vs. Traders and Precious Metals

The precious metals market is but a fraction of the size of the either the stock or bond market and so if even a small portion of either of these markets were to move into precious metals i.e. Gold, Silver or Platinum it could move that market drastically. Many investment advisers recommend having 5-10% of your investment portfolio […]