Total index investing today exceeds 4 Trillion dollars.Why has the share of index fund investing gone from basically zero in 1985, to more than 35% in 2016?

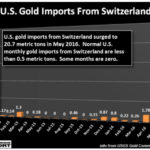

Something Strange in the Gold Market

Gold has a strong negative correlation to other assets. That means that when other markets fall gold can hold steady or even rise. This makes it the ultimate portfolio insurance.

Key Charts For Fed Day

A retest of prior resistance may be in the cards, which is exactly what happened in early 1995. In 2016, the Dow Jones Industrial Average (below) may be in retest mode.

Stocks And Bonds- Testing Key Areas

While the S&P 500 (SPY) was able to push to a new high during Monday’s trading session, the broad NYSE Composite Stock Index (VTI) was still looking for a close above an area that acted as resistance in the past.

The 5 Fatal Flaws of Trading

Close to ninety percent of all traders lose money. The remaining ten percent somehow manage to either break even or even turn a profit — and more importantly, do it consistently. How do they do that?

That’s an age-old question. While there is no magic formula, Elliott Wave International’s own Jeffrey Kennedy has identified five fundamental flaws that, in his opinion, stop most traders from being consistently successful.

These Crisis Markets Are Primed to Deliver Big Gains

Justin Spittler, editor of The Daily Dispatch is talking with Crisis Investing editor Nick Giambruno. Nick shares two key markets he’s keeping an eye on today…

Stocks Sideways While Earnings Tank

Stocks have been flat for 17 months while earnings are declining.

Bonds Continue To Flash Warning Signs For Stocks

When investors are fearful, common sense tells us demand picks up for more conservative assets, which is exactly what happened early Monday morning. When investors are very pessimistic and fearful, return of principal becomes highly important. Therefore, when fear increases we would expect to see defensive bonds outperform growth-oriented stocks.

How Is The Bullish 1994 Stock Analogy Holding Up?

In today’s post Chris Ciovacco of Ciovacco Capital gives us some interesting insight into the current market situation and answers the question:

Is the Market Rallying or is it just a “counter-trend” rally?

He also discusses the three Market myths

And he has a great instructional video at the end.