Scuba-diving is a lot like financial markets. Investors and traders jump in — and use an array of safety gauges to keep them on the right side of price action.

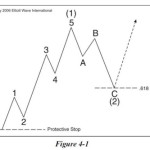

Well, at least those investors and traders who use technical market indicators. For them, those bold, red lines indicating the point of danger — those are equivalent to the most critical component of market analysis: protective stops. The second prices cross this line, it’s time to “swim back up to the surface” and safely re-adjust your position.