In the following video by Elliott Wave International we will look at the gold price and “Commitment of Traders” In 2017, Gold ‘s rally has stalled three times in April, June and August. With April and June’s price stalling at the same overhead resistance level. Back in August Elliott Wave TV said, When analyzing charts […]

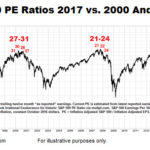

Skeptical Bias Toward Stocks Aligns With Bullish Charts

If someone told us in 1981 the S&P 500 would post a 1,367% gain over the next 18 years, it would have been very difficult to believe after seeing an all-time high in the misery index in June 1980. From miseryindex.us:

“The misery index is simply the unemployment rate added to the inflation rate. It is assumed that both a higher rate of unemployment and a worsening of inflation both create economic and social costs for a country. A combination of rising inflation and more people out of work implies a deterioration in economic performance and a rise in the misery index.”

How Concerning Are Predictions Of A Stock Market Crash?

Since markets are an extremely difficult and complex animal, our purpose here is not to criticize anyone, but rather to highlight the “grain of salt” nature of any stock market forecast. The dated headlines below featured similar gloom and doom calls, and yet, global markets remain near all-time highs.

The Silver/Gold Ratio, Inflation/Deflation and The Yield Curve

The following article was written by Gary Tanashian editor of Notes From The Rabbit Hole (NFTRH) and originally appeared here. In it Gary looks at the current “Dysfunctional Market” the FED manipulation called “Operation Twist” that caused it along with Gold, Silver, plus inflation and deflation. I like his quote about the effects of inflation, “Funny money on the run… is not discriminating money. It seeks assets… period.” and he holds that that is the primary reason why the stock market has risen since 2011.

Are Defensive Assets Waving Red Flags For Stocks?

In good times for the market “growth” stocks, the NASDAQ and higher risk assets outperform “safe” stocks like the S&P 500. This is commonly referred to as “Risk-On”. But as the market becomes more cautious and participants are more concerned about the return OF their assets vs. the return ON their assets, they shift away from risky assets and towards Bonds, Utilities, and Gold.

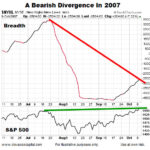

In the series of charts below Chris Ciovacco of Ciovacco Capital Management looks at how defensive assets are faring in the current market compared to how it performed in 2007-2009.

This indicator had a divergence in both 2000 and 2007; a divergence is also present in 2017

Market breadth speaks to the number of stocks participating in an advance. Strong market breadth means a high percentage of stocks are making new highs as the major indexes make new highs. Strong breadth also aligns with widespread confidence in stocks and the economy.

How Concerning Is The S&P 500’s Pullback?

This week’s video reviews the impact of the recent pullback on the longer-term outlook. The video also covers the emotional impact of portfolio draw-downs.

Will Stocks Finally Break out of the 35 Year Box?

Despite all the talk of the Dow making new highs over the last few years the truth is actually quite different. The way an index is “weighted” can make all the difference in how it looks. In addition indexes that change their composition regularly like the DOW (i.e.removing some companies and adding better performing ones) create an unnatural upward bias.

Is Silver Worth Buying in 2017?

Silver investments have a sketchy past. Recently, it came to light that from 2007 to 2013 major players like JP Morgan Chase and HSBC, had been manipulating the price of silver. But that is not the first time the price of silver was manipulated. Beginning in the early 1970s, the Hunt brothers, Nelson, William and Lamar began accumulating large amounts of silver. Until his dying day in 2014, Nelson Bunker Hunt, who had once been the world’s wealthiest man, denied that he and his brothers had plotted to corner the global silver market. Whether they initially intended to “corner the market” or just believed in the ability of silver to protect against double-digit inflation is uncertain but by 1979, they had nearly cornered the global silver market.

In 1979, the brothers had made a profit of from $2 to $4 billion in silver speculation, with estimated silver holdings of 100 million troy ounces (3,100,000 kg). Because the Hunt brothers held the majority of the available above ground supply, silver prices soared from $11 an ounce in September 1979 to $50 an ounce in January 1980. However, like all bubbles this one popped as well, (in this case with the possible help of the government due to the difficulties caused by the lack of supply of silver) with prices falling back to $11 by March 1980. Eventually the Hunt brothers were forced to file for bankruptcy due to lawsuits related to their trading activities. Some see the endearingly eccentric Texans as the victims of overstepping regulators and vindictive insiders who couldn’t stand the thought of being played by a couple of southern yokels.

Even today, many investors still prefer to invest in gold rather than silver. However, 2017 is a shiny new year by many standards. Is this the year to buy silver?

Is Warren Buffett Bullish or Bearish Now?

Actions Speak Louder Than Words — If you want to know what someone really thinks about the stock market, look at their recent portfolio transactions. What can we learn from recent moves made by two of the world’s most respected value investors?