Stock market observers are trying to “make sense” of the wild price moves, which have mainly been to the downside.

As a May 12 CNBC headline says:

Traders search for answers as relentless selling on Wall Street looks to be detached from reality

Many market participants believe the “reality” of economic statistics, earnings and other factors external to the market govern the market’s trend.

However, that’s a fallacy.

Let’s get insights from a classic Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and social trends:

Why Investors are Consistently Fooled by the Stock Market

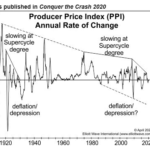

Deflationary Psychology Versus the Fed: Here’s the Likely Winner

Most economists believe the Fed can prevent financial crises and depressions. [EWI’s analysts] disagree. Socionomic theory proposes that naturally fluctuating waves of social mood regulate financial optimism and the economy. They are unconscious and cannot be managed.

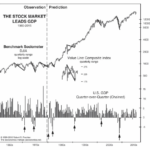

Want to See What’s Next for the Economy? Try This.

Don’t listen to the naysayers — there IS a way to forecast the general health of the economy. This method has repeatedly proven itself. Yes, you can anticipate the likelihood of a recession, even a depression — or, conversely, when major economic measures — like jobs — will be robust.

Robert Prechter Talks About Elliott Waves and His New Book

It’s been a long time since we’ve offered you an article featuring Robert Prechter directly. We’re especially excited to offer you this thoughtful interview Avi Gilburt conducted with Bob.

Non-Traditional View of the Markets

Todd Harrison has vast trading experience as not only VP of worldwide derivatives at Morgan Stanley and Managing Director of Derivatives at the Galleon Group but also President of the Cramer Berkowitz hedge fund. He is also an Emmy award-winning producer with 21 years of experience on Wall Street. But now Harrison uses his expertise to educate […]

Socionomics and the Misery Index

Socionomics is an area of study pioneered by Robert Prechter of Elliottwave International. It is the study of social mood and how it affects economics and politics. Traditional thought has it that good economic times cause euphoria and lead to investor optimism. Socionomic theory stands this on its head and says that investor sentiment is […]

Big Bear Markets: More Than Falling Stock Prices

Fear and uncertainty that drive a severe bear market are the same emotions which can set the stage for authoritarianism, in most any nation. Why do authoritarian tendencies emerge only during bear markets in stocks? Bob Prechter’s new science of socionomics gives you answers.

Goldman Sachs Charged With Fraud: Who Could Have Guessed? Part III

In the November 2009 issue of Elliott Wave International’s monthly Elliott Wave Financial Forecast, co-editors Steven Hochberg and Peter Kendall published a careful study of Goldman Sachs company history — and made a sobering forecast for its future. In this special three-part series, we release that Special Report to you. Here is the final installment, Part III.