Nearly everyone who buys groceries, fills their car tank with gas, pays rent, buys car insurance and so on is talking about the high cost of living. And it’s true that consumer price inflation is higher today than before the pandemic – although, it’s nowhere near as high as it was two years ago, when the annual inflation rate spiked to a 40-year peak of 9.1%.

Is a China-Taiwan Conflict Likely? Watch the Region’s Stock Market Indexes

The likelihood of conflict depends in part on the region’s social mood, as reflected in Asia’s stock market indexes. When social mood is negative, countries are more likely to behave aggressively.

Why You Should Pay Attention to This Time-Tested Indicator Now

Magazine covers can indicate “social mood” and social mood affects the stock market. Could this magazine cover be indicating something, now?

Gold: Setting Near-Term Price Targets

Even though the mainstream media was looking to so-called fundamentals — such as the action of the dollar or bond yields — Elliott Wave International focused on the patterns of investor psychology

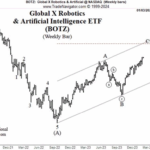

A.I. Revolution and NVDA: Why Tough Going May Be Ahead

The topic with all the buzz these days is Artificial Intelligence (AI) and its future. The potential benefits include automating repetitive tasks, enhancing productivity, data analysis, assisting in medical research — and more.

… the mood surrounding AI is way more optimistic than pessimistic.

Just think about how investors have bid up the price of AI-related stock Nvidia Corp., which has a market capitalization of around $2 trillion. That’s more than the GDP of Australia or South Korea. Indeed, if Nvidia was a country, it would rank just outside the top ten largest economies on Earth. Yet — a word of caution: Trends generally don’t go up or down in straight lines without significant interruptions.

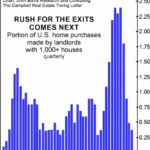

U.S. Real Estate: A 24% Problem

Real estate prices have reached absurdly high prices because corporate investors have taken over the housing market from individuals in a program encouraged, once again, by the federal government. “…24% of U.S. single family homes are owned by investors.” When the bulk of participants in the market are consumers who think of houses as shelter, prices are stable. When a significant portion of participants in the market are speculators who think of houses as investment items, prices soar and crash.

Update on China’s Big Housing Bust

Major red flags for the Chinese real estate market… China’s home prices are falling… Yet, economists have been dismissive of this threat.

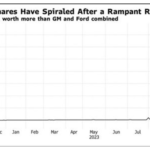

Mini-Manias: Beware Short-Term Trading Frenzies – Like This One

Most investors know the meaning of a “mania,” i.e., the “Tulip Mania” of the 1600s and more recently, the mania surrounding technology stocks in the late 1990s, etc.

As you might imagine, these manias usually occur during rip-roaring bull markets.

Yet, some “manias” may unfold even during bear-market rallies, and when these “mini-manias” end, they can burn investors just as much as those full-blown bull market manias.

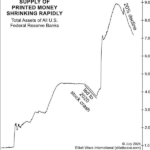

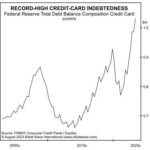

Why You Should Expect a Once-in-a-Lifetime Debt Crisis

The following article by Elliott Wave International looks at the possible impact of the building debt crisis. We’ve all heard about the massive problem of College debt created by the easy-money policies of the government. But today we are looking at the impact of the massive credit card debt.