You can’t go ten minutes on financial media these days without coming across a reference to inflation. That is, consumer price inflation to be more exact — the measurement of changes in the prices of consumer goods and services that the entire world has been hoodwinked by central banks into thinking is the definition of inflation. The proper definition of inflation is the expansion of money and credit in an economy. On that definition, most major economies have been experiencing high inflation for decades.

Bitcoin: Let’s Put 2 Heart-Pounding Price Drops into Perspective

Bitcoin’s price fell hard, from above $58,000 to $45,000, and some are wondering if this is the start of a crash. Well, the word “crash” was also used back in January, when the cryptocurrency fell from $42,000 to below $30,000. However, prices bounced back. Let’s see how Elliott wave analysis can help put both price drops into perspective.

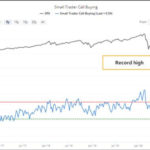

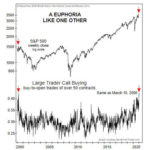

Market Participants are Extremely Bullish

With the current political upheaval in this country, it is difficult to see how the market can be so bullish. In today’s article by Elliott Wave International, we see that the market has “Great Expectations” for 2021. But as we saw in the previous article, Why Most Investors Miss Major Stock Market Turns, often when market-participants are most bullish is at the peak. And its not just amateurs that make this mistake, even “professionals” get caught up in the euphoria. This makes sense in a strange sort of way. When everyone is “fully invested” there is no more money left to flow into the market so it has to go down. And when everyone has taken their money out of the market and put it in “safe cash” there is plenty of money available to drive the market up. Recently Forbes published an article entitled 4 Stock Market Sentiment Indicators: Euphoric-Plus. The old market adage “when everyone else is buying you should be selling” might apply here. Also at the end of this article, you can get free access to the online version (really free- no shipping) of the Elliott Wave Classic, Elliott Wave Principle: Key to Market Behavior ~Tim McMahon, editor

Why Most Investors Miss Major Stock Market Turns

Is Dow 100,000 just down the road? One financial commentator makes the case. At the same time, realize that extraordinarily bold forecasts usually occur at a particular juncture during a market’s trend. ~Tim McMahon, editor

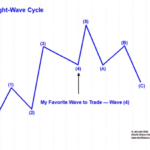

This High-Confident Trade Set-up Makes for Highly-Confident Traders

“Confident trader.” Ten-fifteen years ago, the idea used to be an oxymoron — and now, it’s a multi-billion self-help industry with everyone from Wall Street gurus to armchair experts offering their brand of motivational wisdom:

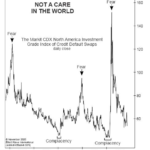

Bond Market: “When Investors Should Worry”

You may recall hearing a lot about “credit default swaps” during the 2007-2009 financial crisis. As a reminder, a CDS is similar to an insurance contract, providing a bond investor with protection against a default.

In the past several months, the cost of that protection has fallen dramatically. The November Elliott Wave Financial Forecast, a monthly publication which provides an analysis of major U.S. financial markets, showed this chart and said:

Does the Stock Market Really “See” the Future?

the market follows the Wave Principle. It is not governed by the anticipation of future events, or for that matter, current events or anything external to the market.

Forecasting Markets by Looking at Chart Patterns

The word “fractal” often means different things to the lay public compared to mathematicians. The public tends to think of fractal art while mathematicians think of the formula that generates the art. The mathematical concept is difficult to define formally, even for mathematicians, but the key feature of a fractal is that if you “zoom in” nothing changes, the same pattern just repeats over and over. The interesting thing is that fractals appear quite frequently in nature. From things as small as DNA, to Snowflakes and Crystals, to Pineapples, Ocean waves and Mountain Ranges, fractals are everywhere. Interestingly, they are also present in the stock market as we look at Minute Charts, compared to Hourly, Daily, Weekly, Monthly, etc.

Seeking Certainty in Uncertain Times?

What seems like ages ago but in reality was just the beginning of this year… life was simple. The market was humming along, unemployment was at record lows, inflation was moderate and life was good. And now just a few months later, there are riots in the streets, unemployment is at record highs, and people are filling up the hospital’s ICUs.

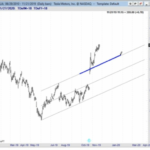

Over the years, we have experienced many ups and downs but rarely in such close succession. But our first line of defense is always the “trendline” (no pun intended). A trendline can tell you both the market direction and its parameters. And if you have read much of what we do, both here and at Financial Trend Forecaster you will know that understanding the trend and using trendlines is a key part of our function.