Investors who use Elliott wave analysis know that the main price trend of a financial market subdivides into five waves. Also know that wave 1 and wave 5 are often approximately equal in length. That knowledge helped the Global Market Perspective, a monthly Elliott Wave International publication that covers 50-plus financial markets, make a successful call on the U.S. Dollar index. The November issue showed a monthly chart which dates back more than 14 years

Stocks Don’t Go Straight Up (or Straight Down)

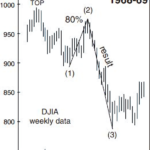

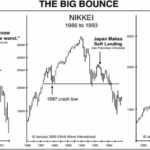

Big stock market trends don’t progress up or down in a straight line. In a bear market, stocks typically rebound after the first leg down. In a bull market, the opposite happens: Stocks again take a big dive, making everyone think the bear market has returned.

But in a bear market, that “first leg down” is wave 1 and the partial “rebound” which follows is wave 2. I say “partial” because the only rule which applies to wave 2 is that it cannot retrace 100% of wave 1. Meaning, the bear market rally cannot go above the previous market top.

How to Prepare for a Hard-Hitting Bear Market (Think 1929-1932)

An important step in preparing for a historic bear market is to embrace cash or cash equivalents.

This may seem obvious, but even with the stock market in a downtrend, cash is shunned by many an investor — retail and professional. Many of these investors believe the bull market will resume — sooner rather than later.

What to Make of the Stock Market’s Bounce

“For certain, there will be countertrend rallies” By Elliott Wave International The stock market selloff from March into the May low was comprised of eight straight weeks of decline in the Dow Industrials. This was historic. The Dow Industrials have been around for 126 years and this was only the second time that the senior […]

Is the Correction Over Yet?

Last week Chris Ciovacco of Ciovacco Capital Management posted a video with his always thorough analysis considering whether this was the last hurrah before a major bear market or the final

test of support before the market resumed its uptrend. He entitled it “Trend Exhaustion or Eminent Plunge” . At around the 5:35 point, that video explains the Demark Studies “9-13” setup for

a reversal and how it plays into this week’s analysis. “9-13” signals on the downside are relatively rare but we got one in May. So, we need to keep an open mind to the possibility of a reversal to

the upside. Even though from a sentiment perspective or even a fundamental perspective it is very difficult to see how any good can be in the pipeline.

Is Bitcoin Headed to Zero?

During the 2008 meltdown gold initially lost value as speculators sold gold to cover margin calls. But it quickly recovered as investors realized that gold was the only asset that wasn’t simultaneously someone else’s liability. So the question arises, “Will Bitcoin turn out to be an Asset or a Liability”?

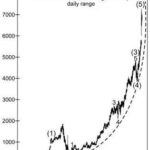

Predicting the Collapse of a “Parabolic Rise”

Sometimes an Elliott wave practitioner must adjust the wave count as a market’s action unfolds. After all, the Wave Principle is an “exercise in probability.” Having said that, the Wave Principle can sometimes offer amazingly “precise results.” And sometimes, the upward trajectory of a stock’s price seems to defy gravity. But “parabolic rises” are impossible to sustain.

The Market is Currently a “Mixed Bag”

In the following video, Chris Ciovacco of Ciovacco Capital Management looks at several market indicators and the recent rebound.

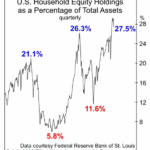

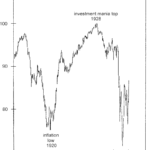

Historically Investors Become “Long-term Buyers” at Precisely the Wrong Time

Typically, unsophisticated investors tend to buy near tops and sell near bottoms… exactly the opposite of what they should be doing. And there is a very good psychological reason for this. They start out cautious and then as others begin making more and more money in the market the Fear of Missing Out (FOMO) takes over and eventually they get in to the market. They may make a little money and decide they are geniuses and commit more and more money. Eventually, everyone with available money has invested and there is no one left to buy so the market crashes. The unsophisticated investor holds on initially knowing the market will rebound as it “always” has. Then he holds on because he has “lost too much to get out now” and finally when he can’t stand it any longer he sells vowing never to invest again. This turns out to be the bottom, as there are no more people left to sell, and the market turns up. But “once burned, twice shy” so the unsophisticated investor once again refuses to buy until the market nears another top and “everyone is making money in the market”.

Why the “60 / 40 Balance” May Be Hazardous to Your Portfolio

Financial advisors have long advocated a mix of 60% stocks / 40% bonds to cushion portfolios from downturns in the stock market. The thinking is that stocks go up in the long-term, hence, that’s where investors should allocate the most. At the same time, advisors acknowledge that stock prices can sometimes go down so “less risky” bonds will provide at least some protection. The problem with this investment strategy is that bonds can go into bear markets too. Moreover, they can do so at the same time as stocks. Let’s review what happened during the Great Depression of the early 1930s.