How does the current 50 day and 200 day moving average on the S&P 500 compare from previous crashes with the current market situation?

They Don’t Ring a Bell at Market Tops (or Bottoms)

Recently I read the following comment on a post about investing in Gold:

Isn’t buying Gold today just like buying a horse ?

It being a purely romantic move for an object with no current use.

Sure it looks pretty and it will still get you there, though slowly,

but why would anyone have it as their primary source of investment travel ?

And I got to thinking that maybe comments like that are the “Bell” that rings indicating a new buying opportunity is at hand. In response I wrote an article entitled, Where’s Gold Headed Today? At the time of the comment, Gold had just finished trading at $1050 and by the time I wrote the article, gold was trading at $1100. As of this writing gold is trading at $1220. So it appears that the commentor made it statement at the precise bottom. But then gold tends to be an “emotional” investment with crazy statements at both the bottom and top. Personally, I think these outlandish comments are more reliable if they come from the general public rather than from seasoned investors.

I remember attending a seminar for computer network professionals in early 2000 and during every break all they could talk about was how they were going to retire on their 401k stock gains which exceeded their salaries. There’s an old saying that “It’s time to sell when the bag boy at the grocery store is giving you stock tips”. Although these guys weren’t “bag boys” they certainly weren’t investing pros either.

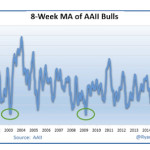

In the following article Chris Ciovacco gives us a different perspective about market sentiment… and gives us this excellent reminder… “Sentiment, like many pieces of evidence can be helpful, but like anything else it should not be used in isolation.” ~Tim McMahon, editor

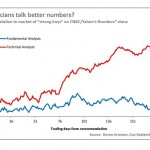

Technical vs. Fundamental Analysis? The Winner is…

Technical versus fundamental analysis: Which approach yields better investment results? A new study by three finance professors offers an answer.

The focus of their study were a thousand pairs of recommendations made between November 2011 and December 2014 on the TV show “Talking Numbers” … The first half of each pair was a recommendation from a top technician about a stock in the news; the second half was a recommendation about that same stock from a leading fundamental analyst.

Elliott Waves Point to Market Probabilities

The “personality” of a third wave shows itself in recent market action. Third waves are wonders to behold. They are strong and broad, and the trend at this point is unmistakable. … Third waves usually generate the greatest volume and price movement … .

How to Use the Stochastic Oscillator

The stochastic oscillator is a popular tool for analyzing a market. Watch the video to learn how you can use this indicator in your trading. Another way to use Stochastic is as a trend analysis tool. In the following video Jeffrey gives a good explanation of the terms “overbought” and “oversold”. He says these two terms are responsible for more lost money among rookie traders than anything else. So watch the video and get some great tips on using stochastics in your trading.

EURUSD: Why Recent Ups and Downs Are NOT Random

How do you know what “your” forex market will do tomorrow? You don’t. All anyone can do is guess. But some guesses are more “educated” than others…

“Markets are doing what they are supposed to be doing: inflicting the most pain on the most number of people. Markets fool the most number of people at the most unexpected moments, but by tracking Elliott wave patterns, sentiment (and the news) you can prepare yourself.”

The Basics of Corrective Waves

The first distinction in Elliott Wave Analysis is between “motive” and “corrective” waves. The primary focus of this lesson is the corrective waves. Corrective waves can be either “ZigZag”, “Flat” or “Triangle”.

Fibonacci Levels Create Key Support for S&P 500

Math plays a big role in nature and the financial markets. Many trading algorithms use Fibonacci retracement levels to identify areas where buyers may become interested (support). The math below may be helpful to us in the coming days – at a minimum, it is prudent to be aware of the possibility of a bounce near 1976 should the market test that area:

Warren Buffett says, The Market is a “Drunken Psycho”

When we look at the recent volatility of the market it is easy to become depressed, confused or just plain frustrated (or perhaps even a little of each). Even the legendary investor Warren Buffet says the market is like a “Drunken Psycho”, so what are mere mortals like ourselves to do? In today’s post we get a little peek into how to beat the market.

Using Trend Lines and Identifying Support and Resistance

One of the most basic skills necessary when looking at a stock chart is using trend lines and identifying support and resistance. Unfortunately, sometimes as we learn more sophisticated methods we tend to forget the basics. So if you are just starting in the markets or you are a more advanced trader, you may find this information valuable.