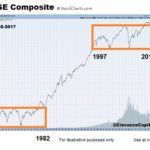

In the following article Chris Ciovacco of Ciovacco Capital Management takes a look at the big picture of the stock market. It is very possible the stock market’s behavior between 2016 and 2034 will be significantly different from its behavior between 1997 and 2015. Therefore, our approach to the markets needs to be flexible enough to handle the possibility of much stronger and sustained trends than what we have seen in our investment lifetimes.

When Prices Are Falling, TWO Numbers Matter Most

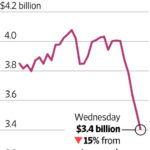

On June 29, the Apple iPhone turned 10 years old. But, for many, the mood surrounding the milestone was less than celebratory. Reason being, in June alone, Apple Inc. (AAPL) plunged 6% to two-month lows amidst a broad-scale bruising of the global tech sector.

SPX CYCLES, FED FUNDS AND GOLD

In the following article by Gary Tanashian of Notes from the Rabbit Hole which he refers to as “NFTRH” Gary looks at the 12 month and 30 month S&P 500 cycle, FED Funds and his proprietary Gold “Macrocosm picture” which includes looking at Gold in various currencies. This is important because since gold is an international commodity, if an individual currency is falling it could appear that gold is rising and if a currency is rising (against other currencies) it could appear that gold is falling. So we need to look at gold in terms of a variety of currencies to eliminate the currency exchange issue and determine what gold itself is actually doing rather than gold versus an individual currency.

Trump Bump Slaughters Market Bears

Much of the post-US election rally in the stock market has been attributed to President Donald Trump’s promises for tax cuts and deregulation. But long before the election, Elliott wave price patterns already told our subscribers to prepare for a market rally.

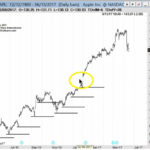

Rare Signal Says Stock Rally Is The Real Deal

Only Three Other Occurrences Since 2002

The True Strength Index (TSI) is a momentum oscillator based on a double smoothing of price changes. As shown in the monthly S&P 500 graph below, a positive momentum crossover (black moves above red) has only occurred four times since 2002. In the three previous cases, the S&P 500 rallied for a long period of time after the crossover; the average gain was 52%.

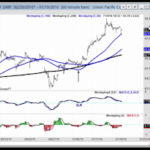

Learning to Recognize Trade Setups with “MACD”

According to Investopedia – the Moving Average Convergence Divergence (aka. MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA.

Is Dow Theory Telling Us The Stock Rally Is Going To Fail?

The Dow Jones Transportation Average has failed to print a new high above the previous high made in 2015. Given the Dow has made a new high, a Dow Theory non-confirmation remains in effect.

How Does 2016 Compare To Stock Market Peaks In 2000 And 2007?

How does the current 50 day and 200 day moving average on the S&P 500 compare from previous crashes with the current market situation?

They Don’t Ring a Bell at Market Tops (or Bottoms)

Recently I read the following comment on a post about investing in Gold:

Isn’t buying Gold today just like buying a horse ?

It being a purely romantic move for an object with no current use.

Sure it looks pretty and it will still get you there, though slowly,

but why would anyone have it as their primary source of investment travel ?

And I got to thinking that maybe comments like that are the “Bell” that rings indicating a new buying opportunity is at hand. In response I wrote an article entitled, Where’s Gold Headed Today? At the time of the comment, Gold had just finished trading at $1050 and by the time I wrote the article, gold was trading at $1100. As of this writing gold is trading at $1220. So it appears that the commentor made it statement at the precise bottom. But then gold tends to be an “emotional” investment with crazy statements at both the bottom and top. Personally, I think these outlandish comments are more reliable if they come from the general public rather than from seasoned investors.

I remember attending a seminar for computer network professionals in early 2000 and during every break all they could talk about was how they were going to retire on their 401k stock gains which exceeded their salaries. There’s an old saying that “It’s time to sell when the bag boy at the grocery store is giving you stock tips”. Although these guys weren’t “bag boys” they certainly weren’t investing pros either.

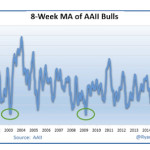

In the following article Chris Ciovacco gives us a different perspective about market sentiment… and gives us this excellent reminder… “Sentiment, like many pieces of evidence can be helpful, but like anything else it should not be used in isolation.” ~Tim McMahon, editor