Even though the mainstream media was looking to so-called fundamentals — such as the action of the dollar or bond yields — Elliott Wave International focused on the patterns of investor psychology

A.I. Revolution and NVDA: Why Tough Going May Be Ahead

The topic with all the buzz these days is Artificial Intelligence (AI) and its future. The potential benefits include automating repetitive tasks, enhancing productivity, data analysis, assisting in medical research — and more.

… the mood surrounding AI is way more optimistic than pessimistic.

Just think about how investors have bid up the price of AI-related stock Nvidia Corp., which has a market capitalization of around $2 trillion. That’s more than the GDP of Australia or South Korea. Indeed, if Nvidia was a country, it would rank just outside the top ten largest economies on Earth. Yet — a word of caution: Trends generally don’t go up or down in straight lines without significant interruptions.

Mini-Manias: Beware Short-Term Trading Frenzies – Like This One

Most investors know the meaning of a “mania,” i.e., the “Tulip Mania” of the 1600s and more recently, the mania surrounding technology stocks in the late 1990s, etc.

As you might imagine, these manias usually occur during rip-roaring bull markets.

Yet, some “manias” may unfold even during bear-market rallies, and when these “mini-manias” end, they can burn investors just as much as those full-blown bull market manias.

Why Do Traders Really Lose Money?

We’ve all probably heard that “the odds are stacked against the small trader” when it comes to the stock market. That tends to push us toward investment tools like index funds. But what if the problem isn’t the market but our own brain? In today’s article, the writers at Elliott Wave International examine the psychological profile that turns winners into losers. Plus, 1 FREE course on how to help you stop self-sabotaging “good enough” trades.

Extremely Rare Market Signal Just Triggered

In today’s article, Chris Ciovacco looks at a few new signals, one has occurred 8 previous times, one occurred 5 previous times and one rare event that has only occurred three previous times in the last 90 years! He will also look at how stocks performed in all of those cases, looking out both months and several years.

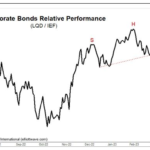

Stocks and Junk Bonds: “This Divergence Appears Meaningful”

The trends of the junk bond and stock markets tend to be correlated.

The reason why is that junk bonds and stocks are closely affiliated in the pecking order of creditors in case of default. The rank of junk bonds is only slightly higher than equities because debt involves a contract.

Given these two markets are usually correlated, it’s worth paying attention when a divergence takes place. Indeed, a divergence is in the works now. In other words, while stocks have been holding up, the price of junk bonds have been trending lower for much of the year.

Market Outlook May 31, 2023

The market soared 27% since the December low. And continued despite the media beating the gloom and doom drum of the “Debt Ceiling”.

Corporate Bonds: “The Next Shoe to Drop”?

A distinct Head and Shoulders pattern exists where the neckline has been broken over the last few days. The corporate bond market has held in reasonably well over the last year, but we fully expect this sector to be the next shoe to drop.

Bull Trap or Market Consolidation?

At the end of last week, Chris Ciovacco recorded his weekly “Short-Takes” market analysis, and overall, things looked quite bullish. Most markets were above their moving averages, trends were turning up, and things were looking good. And then this week, markets turned down, and things got gloomier. But as we’ve said before, Stocks Don’t Go Straight Up (or Straight Down), and Chris said last week that he wouldn’t be surprised to see the markets like the S&P 500 retest the 3900-3950 levels. This is all part of a healthy consolidation. Of course, if markets fall below certain levels, we must reevaluate our position and see if the 2023 rally was just a “Bull Trap” after all. We should remember that the FED is still tightening, and we know “fighting the FED” is generally a bad idea.

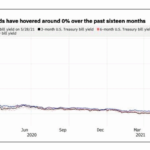

60% stocks, 40% bonds? Ha!

Traditional wisdom suggests a quick and easy “Balanced Portfolio” of 60% stocks and 40% bonds. But there are pitfalls to this type of quick and dirty balancing. Theoretically, when stocks fall, bonds should rise or at least maintain their value. More advanced balancing systems might add a Gold or precious metals component of perhaps 10%. Still, further refinement can decrease the stock portion and increase the bond portion as you get closer to retirement age. On average, a 20-year-old has a lot longer to recover from a market downturn than an 80-year-old. So, a younger person can accept higher risk in return for a higher reward, so a 20-year-old might have 80% in stocks and 20% in bonds. An 80-year-old, on the other hand, might have 80% in Bonds and 20% in stocks. In the following article, the Editors at Elliott Wave International look at some of the pitfalls of the balanced portfolio approach. ~ Tim McMahon, editor