One of the keys to making more prudent and rational decisions is to look at more than just the red screen in front of us, which represents only one timeframe (the shortest). It can also be helpful to think in extremes.

Using Longer Timeframes To Combat Volatility Fatigue

A December 2016 video covered an extremely rare signal that occurred in 1982 and 2016. Since then, markets have reacted in a bullish manner, meaning we have no reason to doubt the long-term signal that occurred at the end of 2016. Therefore, it may be helpful to understand the stock market’s volatility profile between 1983 and 1985.

Recent Breakouts Say a Lot about Markets and Economy

When investors are confident about future economic outcomes, they tend to prefer growth-oriented XLY (consumer discretionary) over defensive-oriented XLP (consumer staples). The 2002-2009 chart below shows the XLY:XLP ratio consolidated for several years before breaking down in October 2007.

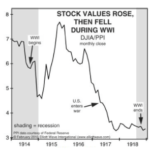

Are Wars Bullish or Bearish for Stocks?

The following article was originally published by Elliott Wave International under the title Is War “Hell” for the stock market? And it looks at the stock market performance during various wars and also during times of peace to see if there is a correlation between the market performance and the existence or absence of war.

Tariffs May Not Slow Profit Momentum

BIG IMPACT OR SMALL IMPACT? U.S. Treasury Secretary Steven Mnuchin indicated Sunday the U.S. is hopeful to strike a deal with China, which means the tariffs would never go into effect. However, if a deal cannot be reached, how significant are the tariffs relative to the big picture? From CNBC: Jeremy Zirin, head of investment strategy […]

Urgent Message: Two Must See NASDAQ Charts

The NASDAQ index was launched in 1971 as the world’s first electronic stock market. With $7 Trillion in market capitalization it has grown to become the second largest market behind the NYSE. The NASDAQ has been in an upward sloping channel since 2011. But now something has happened. See this video for more information.

Bitcoin Crashes Below $10,000. What’s Next?

Who could have thought that something called a “digital currency” that first appeared in 2009 and was widely available for 1 cent (and no one cared!) eight years later would be going for $20,000 a pop? It’s the wildest financial craze of our time. Wait, scratch that — it’s the wildest financial craze ever, because Bitcoin is up not 100%, not 1,000%, not even 10,000%. Since inception, Bitcoin is up 32,000,000%. Yes, thirty-two MILLION percent.

Stocks Can’t Keep Going Up Forever… Or Can They?

Wall Street traders love to live by “truisms”, “clichés”, and/or “maxims”. One such refrain that we constantly hear is that “Stocks can’t keep going up forever” but then there is “the trend is your friend” and “the market climbs a wall of worry”. When you put them all together what do you get? Should you worry about a top or should you be happy that others are still worried… because that means the top isn’t here yet? After-all, the market continues to climb until everyone has bought. If there are still bears out there, they are still potential buyers. On our NYSE Rate of Change page we published a couple of charts by “Chart of the Day” which showed the average length of rallies before a 15% and 20% decline. But if you take a longer term view, even a 15-20% correction could be inside a longer term bull market.

In today’s post, Chris Ciovacco of Ciovacco Capital Management takes a look at the historical precedent for the current market.

New Long-Term Equity Breakout

On Tuesday, CME and CBOE TV financial commentator Alan Knuckman said on Fox Business, “Trump’s historic tax cuts will boost most American corporate earnings lines by at least 20% in 2018 — sending stocks soaring still from their current levels.” He is predicting that the Dow will reach 30,000. He said, “The Dow Jones Industrial Index is now within 21% of the 30,000 milestone which is very achievable after returning 25% in 2017.”

But after being up so much in 2017 isn’t it “overvalued”? You might ask. One reason for optimism is that even after being up so much earnings are up about the same amount. So the P/E ratio is roughly where it was a year ago, i.e. slightly above 21%. That is just slightly above the average level and well below peak levels. With corporate earnings up another 20% due to tax reform this year, prices could go up that much as well and the market still wouldn’t be overvalued.

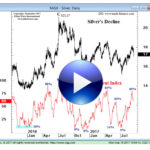

Silver Chart of the Day

Silver has had several major peaks over the last year. But interestingly sentiment has been an excellent indicator of peaks. In this video we will look at the correlation between Silver’s price and market sentiment.