Two of the greatest motivators in the financial arena are Fear and Greed. Unfortunately, many traders fall victim to their enticement and end up making disastrous mistakes. But by getting your emotions under control you can follow the sage advice of Warren Buffet and “Be fearful when others are greedy and greedy when others are fearful”.

How to Build Consistent Trading Success

You’ve heard it all before:

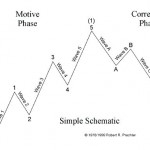

If you want to trade using Elliott wave analysis, to succeed you first need to understand its rules and guidelines.

You need a clearly defined trading strategy (what? when? how? etc.) and the discipline to follow it.

Additionally, your long-term success depends on adequate capitalization, money management skills and emotional self-control.

Do you meet these qualifications, yet still struggle in the markets? If so, you may find some helpful advice in this quick trading lesson from Trader’s Classroom editor, Jeffrey Kennedy:

Is Gold on the Verge of a Bottom?

From 2017 until now the Gold chart shows another 75% price retracement from recent highs once again. This second 75% retracement could be a massive bottom formation setting up in Gold and could be a huge “wash-out” low price. We believe this unique retracement is indicative of a massive price breakout over the next year or so as the price of gold is forming what Stan Weinstein calls a Stage 1 Accumulation.

The 5 Fatal Flaws of Trading

Close to ninety percent of all traders lose money. The remaining ten percent somehow manage to either break even or even turn a profit — and more importantly, do it consistently. How do they do that?

That’s an age-old question. While there is no magic formula, Elliott Wave International’s own Jeffrey Kennedy has identified five fundamental flaws that, in his opinion, stop most traders from being consistently successful.

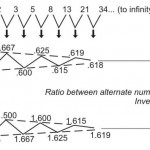

How to Identify Turning Points in Your Charts Using Fibonacci

Leonardo Fibonacci (aka. Leonardo of Pisa) was the son of a merchant and well educated in the use of numbers while keeping his father’s books but in those days all of Europe used “Roman Numerals” and calculations were difficult. Leonardo was instrumental in bringing the Arabic numeral that we use today to Europe. But although […]

What is Forex News Trading?

The Forex market remains a source of great opportunity for investors, thanks primarily to its high levels of leverage and liquidity. It is a margin based investment opportunity, which enables shrewd and experienced operators to gain returns that can dramatically exceed their initial financial commitment. But it also brings considerable risk, however, as less fortunate traders […]

Independent Investors Should Explore Trading Options

Three investment sectors, Energy, Home Construction in the United States and Precious Metals are predicted to do very well in 2013. Last year, they performed moderately with gold hitting an all-time high in 2011 and nearing that high again in 2012. The 2008 recession has countries and traders all over the world still leery. Although […]

5 Qualities of a Winning Forex Trading Platform

Forex Trading Platform Hundreds of different Forex trading platforms are available for investors of all different levels and backgrounds. Choosing the right one is essential to making the most of your trades and maximizing your profit potential. Most of the platforms available for you to choose from look similar. This means that many traders, especially […]

Trading Online

In the past, investors had to pick up the phone and call their broker when they wanted to place a trade in the financial markets. While this is still an option for traders, most people now do their trading online. Thanks to advancements in technology, you can trade faster and easier without contacting a middleman. […]

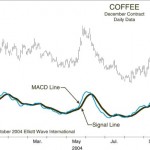

Hooking Potential Trade Set-ups

How to Combine Technical Indicators with Elliott Wave Analysis By Elliott Wave International Trading using technical indicators — such as the MACD, for example, Moving Average Convergence-Divergence — can do one of two things: help you or hinder you. Using them as a forecasting method alone can be about as predictable as flipping a coin. […]