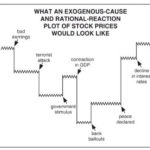

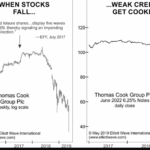

As Elliott Wave International has noted many times, the mainstream financial press always tries to find a reason for a given trading day’s stock market action.

In other words, if stocks happen to be up for the day, many financial journalists will say it was because of this or that “positive” news. If stocks happen to be down for the day, you got it, these journalists will ignore the positive news and search for something “negative” that happened in the country or world and say that was the reason stocks went down.