You’ve heard it all before:

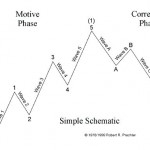

If you want to trade using Elliott wave analysis, to succeed you first need to understand its rules and guidelines.

You need a clearly defined trading strategy (what? when? how? etc.) and the discipline to follow it.

Additionally, your long-term success depends on adequate capitalization, money management skills and emotional self-control.

Do you meet these qualifications, yet still struggle in the markets? If so, you may find some helpful advice in this quick trading lesson from Trader’s Classroom editor, Jeffrey Kennedy: